Is your tour and activities company struggling with chargebacks? If so, you’re not alone. Everyone who does business online deals with chargebacks from time to time, and customers are becoming increasingly bold about seeking chargebacks for fraudulent reasons.

When a customer goes to their bank or credit card provider for a chargeback rather than seeking a refund, the financial hit can be frustrating — particularly when they’re doing it to get around your policies. But that’s not what keeps business owners up at night. Rather, it’s that risk that if a company’s chargeback ratio gets too high, most payment providers will shut down their merchant accounts without a second thought. If that happens, most others won’t be willing to take them on.

Because of that, avoiding chargebacks is becoming a top priority for anyone who does business online — or anyone who takes credit card payments at all.

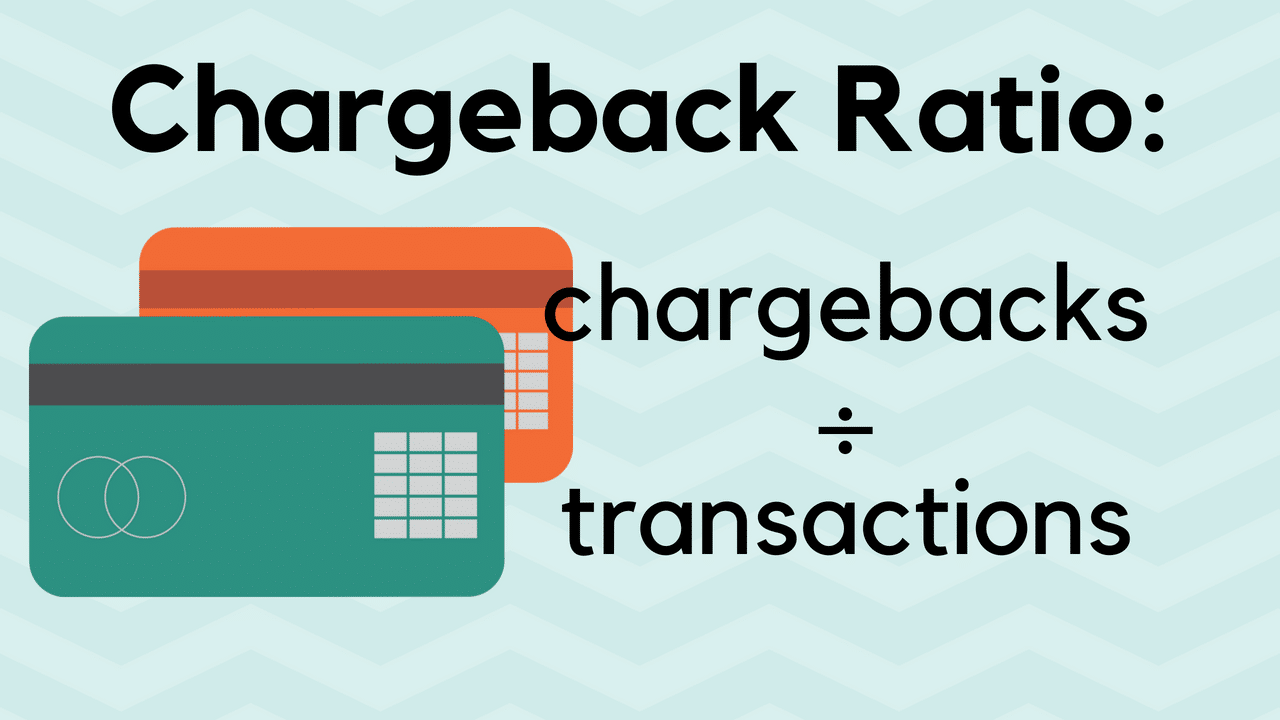

What’s your chargeback ratio?

Chargeback rates in the travel industry are on the rise, both from Card Not Present (CNP) fraud and for other, more challenging reasons. According to Chargeback911, the travel industry tends to range from a chargeback ration of 0.89% to 2%. To learn how you stack up against those numbers, you first need to figure out your own chargeback rate.

The calculation is simple: take the total number of chargebacks you experience in a month and divide them by the total number of credit card transactions you had in that same month. A single chargeback in a month with 200 transactions would give you a chargeback ratio of .5 percent. If your transaction volume is lower than that, you may also want to average a few months to get a more accurate sense of your rate.

Ideally, you want to keep that number well under 1 percent. Higher rates increase your chance of being identified as a high-risk merchant. After you’ve been identified as a high-risk merchant, you may have your account terminated by your payment gateway, and you may be placed on the Member Alert to Control High Risk Merchants (MATCH) list, at which point it will be difficult or impossible to get a new merchant account.

Unfortunately, your chargeback rate isn’t entirely in your control — but there are steps you can take to keep it as low as possible.

Avoiding chargebacks

Assuming you treat your customers fairly and provide the service they’re paying for, most of your chargebacks will be fraudulent in some way. Card Not Present fraud is a major category for travel and ticketing, making up about 60 percent of all chargebacks according to Kount. Much of the remainder is “friendly fraud” — chargebacks from customers who are inventing or exaggerating the reason for the request.

Avoiding chargebacks due to CNP Fraud

In the travel and event sectors, chargebacks are often due to Card Not Present fraud — in other words, they’re usually related to fraudulent bookings made with stolen credit cards.

The best way to avoid CNP fraud is to automate your credit card processing as much as possible. When you use an online booking platform like Rezgo, you can take bookings through the web with a payment gateway. Because payments go directly through the payment processor, you benefit from any protection their fraud prevention techniques offer.

Taking credit card payments in person or over the phone can be trickier. Using Rezgo’s payment requests can help, as those let you request secure, online credit card payments for any transaction, regardless of where you communicate with your customers.

The more manual your process is, the more carefully you’ll need to examine the cardholder’s identity, address information, and other verifiable details, and the more evidence you’ll need that they really were the ones making the payment.

No matter how good your process is, though, some credit card providers won’t care. For some, only surefire evidence that a purchase was legitimate was an in-person card swipe or in-person chip use. That means your best option is always to avoid the chargeback before it happens.

Avoiding chargebacks due to friendly fraud

As nice as it would be to reassure you that friendly fraud won’t happen if you’re good to your customers, it’s not true. Online shoppers have been emboldened by lax enforcement from credit card providers, and many now see chargebacks as an easier alternative to getting a refund.

It certainly doesn’t help that disputing a chargeback can be shockingly difficult even when you’re completely in the right.

So how do you prevent chargebacks from ever happening? There’s no surefire way, but here are some steps you can take that may help. When in doubt, talk to your merchant gateway for their recommendations.

Know your customer

The best way to avoid chargebacks is to deal with customers you trust. Given that you probably don’t want to start turning away new customers, this can take a little finesse.

First, make sure you have all the information you need. Accurate and complete customer information will help protect you against fraudulent claims of stolen credit cards and theft.

Reminder emails or texts can also give a customer a sense of connection, which will help in a conflict. If your customers feel they can talk to you directly, they’re more likely to come to you about disputes before going straight to their credit card providers.

Finally, watch out for red flags that signal suspicious transactions. You can save your company a lot of grief by cancelling a fraudulent transaction before anything comes of it.

Make sure your customer knows you

It may seem like a silly thing, but if customers don’t recognize a transaction on their credit card statement, they might dispute it before realizing that it’s legitimate.

Check with your merchant account provider to make sure that your transactions will appear under a company name your customer will expect. If not, include that information on your receipts.

While you’re at it, ensure that your contact information is easy to find on your website and emails. If a customer can’t find you when they have issues with their booking, rest assured that they’ll find their credit card provider without difficulty.

Keep your content accurate

When a customer is looking for grounds to file a chargeback, inaccurate tour descriptions are a dream come true. If they have written evidence that they were misled about what they were purchasing, you won’t have much of a chance in a dispute.

Clear, accurate tour details are an important element of your booking website.

Keep your website information, tour descriptions, email content, and promotional details accurate and up to date. If you don’t, you’re handing a dishonest customer ammunition to use against you, and an honest customer reason to distrust you.

Have a straightforward cancellation policy

Many chargebacks are initiated because customers believe it’s easier to go to their credit card provider for a refund than it will be to go to the merchant. The easier you can make it to cancel or get a refund, the more likely it is that an unhappy customer will at least try to contact you before initiating a chargeback.

Customers will also turn to chargebacks if they’re promised a refund that’s slow to arrive, so take care to be prompt when resolving cancellations.

Offer ticket protection

Emergencies happen. If a customer can’t attend the event they booked and your cancellation policy means they won’t get a refund, they’re likely to turn to chargebacks.

Avoid the problem entirely by offering refund protection. Rezgo has partnered with an insurance provider to allow your customers to protect themselves against the unexpected. If they are unable to attend the event and have a good reason, they’ll be covered — at no cost to you. If they choose not to protect their purchase, you’ll have one more argument in your favor when it comes time to dispute a chargeback.

Keep good records

If it does come down to a dispute, you’ll need all the corroborating information you can get your hands on. Your booking platform should provide you with all the details you need about the booking and payment in question. Booking software can’t protect you from chargebacks–that’s between you, your customers, and their credit card providers–but data can help when it comes time to gather evidence.

Even if you don’t take bookings online, you can use Rezgo to track availability, keep records of bookings and check-ins, store waivers, and help you protect yourself when dealing with fraud.

Finally, the best records are ones that prove your customer attended the tour or activity. If you can take photos of your guests (which can also give you a great opportunity for an up-sell!) or get other visual records, it can help.

We’re in this together

Chargebacks are a frustration every tour and activity provider has to deal with occasionally, so remember, you’re not alone.

Across industries and around the world, merchants are pushing for chargeback regulations that will help them avoid customer fraud. So far, credit card providers have been reluctant to implement more stringent controls, but new technologies may one day lead to verifiable, trustworthy transactions — and much less fraud.

Until then, all any of us can do is our best. Take the time now to make sure you’re doing all you can to avoid chargebacks, and your future self will thank you.

Search The Blog

Categories

Most Popular Articles

- Advantages and Disadvantages of Online Travel Agencies (OTAs)

- Set-jetting, Forest Bathing, and Hush Trips: 20 Innovative Tourism Business Ideas and Trends for 2023

- Your Marketing Mix: the 7 Ps of Travel and Tourism Marketing

- How to Create and Promote Amazing Tour Packages

- Get More Bookings With These 9 Tourism Website Essentials